Alibaba And The Ant Group Saga (NYSE:BABA)

maybefalse/iStock Unreleased via Getty Images

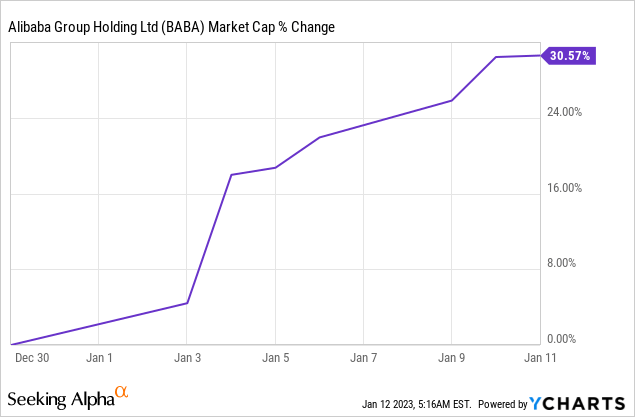

Shares of Alibaba (NYSE:BABA) have started to soar this week after it was reported that Jack Ma, Alibaba’s founder and a major shareholder of Ant Group, is giving up control of the FinTech start-up. With Chinese authorities working toward a full economic reopening and now positive news with respect to Jack Ma’s Ant Group holding, I believe Alibaba has cleared most of the negative sentiment overhang that has dragged shares down to new lows in FY 2022!

Mục Lục

The Ant Group saga is finally ending

The Ant Group, which owns the world’s biggest mobile payment platform Alipay, planned its $37B IPO in Hong Kong and Shanghai in 2020 before Chinese regulators stepped in and prevented the FinTech to float on a public stock exchange. The canceled Ant Group IPO was seen by analysts as an increasingly assertive attempt of the Chinese Communist Party to reign in large Chinese technology companies and cement control over the corporate sector. Ant Group is an affiliate of Alibaba which owns about 33% of the FinTech. The canceled Ant Group IPO in 2020 has also weighed on Alibaba’s valuation due to growing concerns over the involvement of Chinese authorities in large tech companies.

In an announcement made this week, Ant Group said that Jack Ma will no longer control the FinTech in a major bid to appease Chinese regulators. Alibaba’s billionaire founder indirectly owned 53.46% of the shares of Ant Group and a major change in the governance structure requires Jack Ma to no longer act in concert with other shareholders. Effectively, this means that Jack Ma’s influence and ability to influence strategic decisions such as the nomination of directors on Ant Group’s board of directors will be reduced. The move is also taking pressure off of Alibaba’s valuation which has soared after the announcement.

Economic reopening could be a catalyst for Alibaba’s ailing commerce business

After a year of brutal lockdowns, the Chinese government has said that it will loosen draconic restrictions it imposed on its citizens in 2022 to mitigate the spread of COVID-19. For the first time in three years, China is also officially reopening its borders to international travelers, which is a sign of normalization that Alibaba investors will surely appreciate.

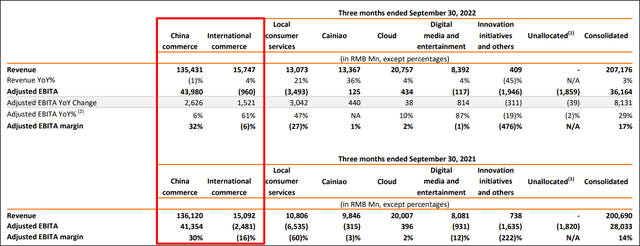

I believe a full reopening of the Chinese economy is a potentially powerful catalyst for Alibaba’s China-centric e-Commerce business. Alibaba’s commerce enterprise in China has suffered the most severe slowdown of all of Alibaba’s segments in FY 2022: revenue growth in China’s commerce business slumped to (1)% in last year’s June-quarter. In the September-quarter, China commerce revenues continued to drop one percent year over year, showing two consecutive quarters of negative top line growth in Alibaba’s biggest segment.

China commerce revenues accounted for 65% of Alibaba’s consolidated revenues in FQ2’23 which was 6.5 times larger than the revenues generated from Alibaba’s second-biggest business Cloud. A broad reopening of the Chinese economy and the release of pent-up demand could be a huge boost for the bruised e-Commerce business which was largely responsible for Alibaba’s consolidated top line growth slowing to just 3% in the September-quarter.

Source: Alibaba

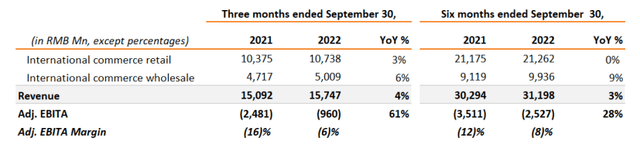

As the Chinese economy reopens and COVID-19 restrictions are eased, Alibaba’s international segment could see a strong rebound as well. Chinese manufacturers are returning to full production capacity and can therefore fulfill international orders without delay. Alibaba’s international commerce accounted for 8% of revenues in the September-quarter and could, if e-Commerce sales rebound in 2023, challenge Cloud’s 10% revenue share and become Alibaba’s second-most important segment regarding revenue contribution.

Source: Alibaba

Alibaba’s valuation

I am possibly more optimistic than other investors regarding Alibaba’s revenue potential in 2023 and beyond. This is because Alibaba’s growth — despite a growing importance of segments such as Cloud or Logistics — Alibaba’s Chinese commerce operations remain the single most important source of revenues for the company due to an outsized revenue share of 65%.

A full reopening of the Chinese economy could result in a reinvigoration of Alibaba’s e-Commerce and top line growth, and I believe a return to double-digit revenue growth is possible in FY 2024. The expectation is for just 3% revenue growth in FY 2023, but a reopening would likely deliver broad-based strength to Alibaba’s core businesses including e-Commerce, logistics and Cloud.

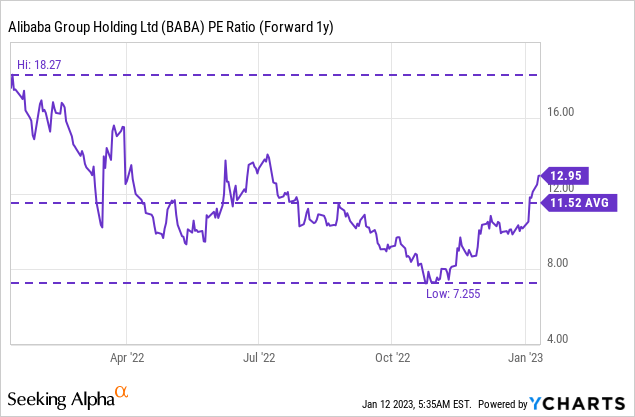

Based off of earnings, I don’t believe investors paying an outrageous price for Alibaba’s recovery potential: shares are currently valued at 13.0 X forward earnings, but investors are –due to the Ant Group-related news in January — paying more than the 1-year average P/E ratio of 11.5 X.

Data by YCharts

Data by YCharts

Risks with Alibaba

The biggest short term risk for Alibaba is that the Chinese economy is not reopening according to plan. COVID-19 infections are soaring in China and some countries have started to place restrictions on Chinese travelers as a result. Considering that Alibaba’s top line growth really did slow down dramatically in 2022, there is a possibility that a delayed reboot of the China-centric e-Commerce business could make Alibaba’s revenue position worse in the short term.

Final thoughts

Jack Ma ceding control of Alibaba is very good news for the e-Commerce company and its shareholders. Uncertainty about the FinTech’s future has weighed on Alibaba’s valuation ever since Chinese regulators halted the Ant Group IPO in 2020. With the Alibaba founder finally giving up control of the FinTech, investors have also reason to assume that Chinese regulators will take pressure off of Alibaba. A full reopening of the Chinese economy and the unleashing of pent-up demand could be a powerful catalyst for Alibaba’s dominant e-Commerce business. Since risks related to Alibaba appear to be receding, the Chinese e-Commerce firm continues to have recovery potential in 2023. I currently have a hold rating on Alibaba, but I am prepared to upgrade my rating to buy/strong buy if the Chinese reopening proceeds as expected and Alibaba avoids a negative growth quarter in FQ3’23!