Alibaba Stock: Ant Group Still A Good Long-Term Driver For Alibaba (NYSE:BABA)

Future Publishing/Future Publishing via Getty Images

We rate Alibaba (NYSE:BABA) stock as a “buy” with an intrinsic value for a base case scenario of $138.98 per share without considering Ant’s valuation. Incorporating an approximation of the Ant Group’s intrinsic value and subtracting the expenses for the common prosperity to the base case scenario, Alibaba’s intrinsic value might reach $151.23 under very conservative assumptions, and under a buy-and-hold strategy for the long haul.

Alibaba has 33.3% of stake in Ant Group whose IPO was halted in 2020 when China began a heavy-handed crackdown on its big tech companies. In 2020, Ant Group was expecting to raise $34.5 billion in its IPO with an estimated valuation for the company of around $350 billion. However, the new regulations of Ant’s operations triggered several doubts about its future valuation after that crucial event. In this article, we’ll offer some information that will support our thesis that Ant Group still has some value to offer to Alibaba’s investors even when Ant has experienced significant changes in its operations due to the new regulations. We’ll incorporate an estimated worth for Ant Group into the Alibaba’s valuation to know more about Ant’s contribution to the Alibaba’s intrinsic value. We’ll take an additional step calculating the effect of the common prosperity policy into Alibaba’s valuation.

Let’s dive a little bit more into Ant Group’s business model and its changes in order to know what to expect in a potential next IPO.

Mục Lục

Context

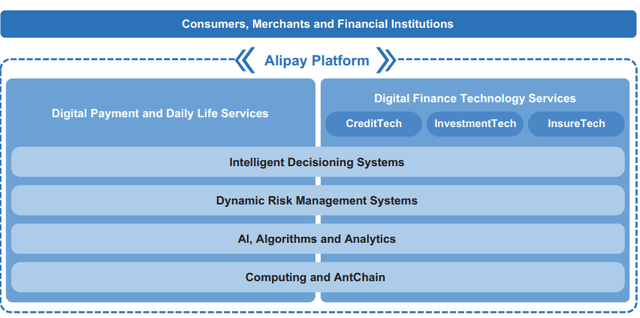

Before the crackdown in 2020, Ant developed an ecosystem around its platform through the building of digital infrastructure for ecommerce and services. Those players who are part of that ecosystem are consumers, merchants, financial institutions, third-party service providers, strategic alliance partners and other businesses.

Prospectus IPO 2020

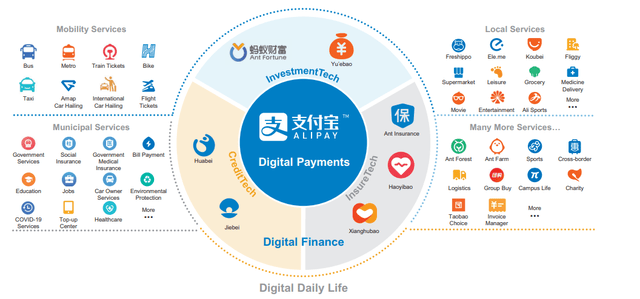

The access for consumers to that ecosystem is Alipay which is a payment processor that was created in 2004 – in the first stage of the ecommerce in China to solve trust issues between buyers and sellers; over the years, Alipay evolved to be an ecosystem platform that includes other services such as loans for consumers and small and middle size businesses (SMBs), investment funds, and insurance.

We see how Alipay is an opened door to other services which implied the management of the data of its more than a billion of users:

Alipay’s ecosystem (Prospectus IPO 2020)

With Alipay, the user had access to other services such as the Creditech Unit which included loans for consumers and SMBs; the Investment Tech unit, which included different financial products for wealth management, and finally, the InsureTech unit which offered different insurance products.

Changes in Ant’s business units

There were two products under the Creditech Unit; Huabei which allows users to get loans for daily expenses, and Jiebei which enables users to get loans for larger consumption transactions. Also, this Creditech unit served SMBs, offering different loan products according to their needs. In general, all these loans were flexible, unsecured with flexible terms and affordable rates with instantaneous drawdown.

The main problem found by the Chinese regulators was that around 98% of the total credit balance originated in Ant’s platform were loans underwritten by other financial institutions that work as Ant’s partners. These financial institutions are under the supervision of the People’s Bank of China (PBOC), so they are required to make provisions and make risk assessments of each of those loans. For instance, Ant offered the data to help banks in making those risk assessments of each individual or each small business, receiving a fee as compensation for that service.

It was clear that there was an unbalanced situation since banks assumed most of the risks associated to the loans underwritten while Ant had all the incentives to deliver its platform services to these banks with the respective data without affording any of those risks. If there would have been a dubious-quality data, all the risks would be entirely assumed by the banks not by Ant.

In this sense, looking for solving this problem, the regulators asked Ant Group to set up an independent credit score company through a joint-venture with state-back partners; this joint venture, called Qiantang Credit, is 35% owned by Ant and the rest is owned by state-owned financial institutions. With this company, Ant would have a third-party company delivering credit scoring services.

Another step taken by Ant as requested by regulators is to separate all the services such as loans, investment funds and insurance from Alipay which implies that the investment funds and insurance are being subject of the respective regulations in each of both industries.

Chongqing Ant Consumer Finance

Some months before the IPO in November 2020, the fintech was required to set up a consumer finance unit, Chongqing Ant Consumer Finance Co (CACF), which is already licensed to manage all the financial services offered under the former Creditech unit that included loans to consumers.

As per the prospectus of Ant’s IPO in 2020 on page 596:

Events after the relevant periods On 21 August 2020: the Group entered into an agreement with other investors to jointly initiate and establish Chongqing Ant Consumer Finance Co., Ltd. The China Banking and Insurance Regulatory Commission granted an approval on September 14, 2020 to commence the preparation for the establishment of Chongqing Ant Consumer Finance Co., Ltd. By the end of September 2020, the amount of registered capital the Group subscribed to was RMB4 billion, accounting for 50% of its registered capital. Except for the events above, the Group did not have any other significant events after the end of Relevant Periods which needs to be disclosed.

It was clear that regulators were asking Ant for the implementation of this consumer unit before the supposed IPO in November 2020, which means that it was having serious concerns even before the IPO. Considering that Ant would have 50% of the ownership of that new consumer finance unit, now we know that the rest would be taken by some state-own institution even when it was not mentioned directly in the prospectus in 2020. Of course, very few investors were aware of this when the IPO was close to be released.

CACF is now allowed to lend to individuals, issue bonds and borrow from domestic financial institutions. Apparently, this new consumer unit does not include the Ant’s investment funds and insurance business units, but we estimate that they will be subject of regulations associated to those industries.

We do not have information if a new financial unit would be released for both businesses. Most of the information about the matter are not clear respect to the inclusion of the investment funds and insurance business as part of CACF. Also, we do not have more details about how Ant will provide loans to the SMBs; for instance, it is unclear if those loans will be offered through CACF or outside of it. Anyway, these details will be offered in a potential next IPO.

In general, the purpose of the CACF’s creation was to allow the participation of the Chinese government through its state-own companies within this important Ant’s unit. This is a common practice in the Chinese banking sector in which the government has a participation in each of the most important banks in the country.

Ongoing process of Ant Group to be transformed into a Financial Holding Company (FHC)

Ant Group is in a process of being turned into a FHC; this indicates that this FHC will be subject to the regular financial regulations in China. For instance, before the halting of the Ant’s IPO, we know that 98% of the loans in the Ant’s balance were underwritten, not by Ant, but by the Ant’s financial partners which were the Chinese banks.

Now, with these new changes, Ant would have a very much lower percentage of loans provided by these financial institutions using the Ant’s platforms, increasing substantially the loans offered by Ant directly through the CACF. We don’t have numbers yet, but it would be expected to see provisions for loan losses in the Ant’s income statement as in the case of any regular bank.

Implications of the new regulations in Ant

With a new credit score system under an independent company, Qiantang Credit, and a new consumer finance unit that is within CACF, which would be, jointly with the investment funds and insurance businesses, a FHC and where there is a participation of the Chinese government, Ant Group would have a much higher supervision but, at the same time, a more long-term orientation.

Considering that Ant is offering financial products to unserved and underserved sectors such as SMBs and consumers segments which need a higher penetration in China; we still would expect sustainable growth over the years. Indeed, as per the National Bureau Statistics, 99.8% of the businesses in China are SMBs; as such, it’s clear that these SMBs, which are not adequately served by traditional banks, will need more sources of financing for their operations. Managing the data from borrowers, as one of its core intangibles, Ant Group is able to please these needs without taking significant risks.

Furthermore, as per UBS, the penetration ratio in private banking services in China was estimated to be only 31% in 2019 expecting this ratio to be 50% by 2025.

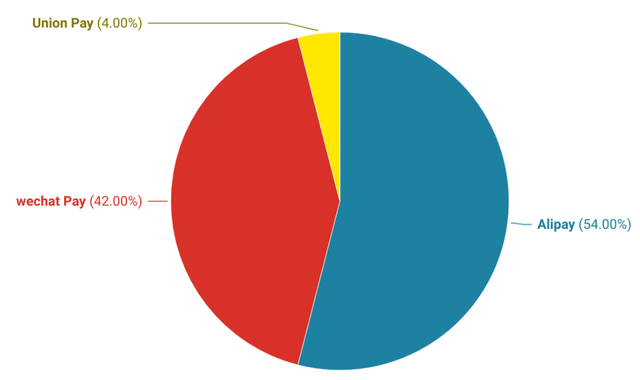

The market position of Alipay is crucial to take advantage of these long-term tailwinds:

Market Share 2021 (Enterprise Apps Today )

The separation of Alipay from loans, investment funds and insurance services, which is another regulatory requirement, means that there will not be a sharing of the data in all these services as before the halting of the last IPO; therefore, there will not be a cross-selling which will slow down, unavoidably, the Ant’s revenue growth. However, the management might elaborate strategies to take advantage of the Alipay’s market share to grow its investment funds and insurance business units, complying, at the same time, with the regulations.

All in all, with lower revenue growth and lower net margins due to the inclusion of provision for loan losses and capital requirements in the Ant’s income statements, it would be expected lower multiples for the Ant’s stock considering a hypothetical IPO 2.0. Nevertheless, regulations are created to make the financial system more resilient in scenarios with high uncertainty; thus, we see these regulations as something positive despite the abrupt changes that caused so much fear among investors. In this sense, we expect a more sustainable long-term growth not only for Ant but also for the Chinese financial system, as there are more conservative policies established by regulators.

On the other hand, the Chinese government is well aware about how critical is a company like Ant Group for the Chinese economy. In this sense, Chinese regulators have approved a raise of capital for Ant Group, particularly for its consumer finance unit CACF, of RMB 10.5 billion considering that in the prospectus for the IPO in 2020, Ant already had a registered capital of RMB 4 billion.

As per Wang Pengbo, a senior analyst at market consultancy Botong Analysis (linked above):

the capital expansion approval for Ant Group has signified that the company’s rectification work has made some achievements to meet regulatory requirements, and the move will help the company to expand its current consumer finance business scale and seek further growth.

Another recent step taken by regulations that help advancing the ongoing process for a potential next Ant’s IPO is that the indirect control of Jack Ma over Ant has been reduced from 50% to only 6%. This changes assuage regulators and the Chinese government as Jack Ma had a very important control of a critical company like Ant that was growing without any supervision and competing with the most important state-own banks that are the foundation of the Chinese economy.

Ant Group’s valuation and its contribution to Alibaba’s intrinsic value

Valuation of Ant Group

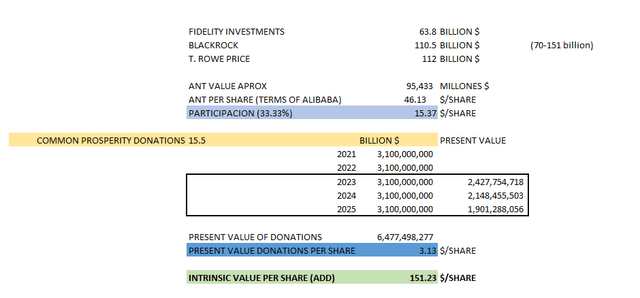

There are some institutions that were launching their estimates of Ant Group’s intrinsic value considering the changes in its operations due to the Chinese crackdown. In January 2023, Fidelity assumed a valuation close to $64 billion, while BlackRock is way more bullish estimating $151 billion of valuation as of April 2022 and T. Rowe Price estimates $112 billion as of May 2022.

All these estimates show a significant cut with respect to the pre-IPO valuation in 2020 of around $350 billion. This is aligned with what we’ve mentioned previously about the inclusion of new loan loss provisions and lower revenue growth for the next years, and as result, lower multiples. Now, we’ll take all these estimates of the Ant Group’s intrinsic value to be included as part of the Alibaba’s intrinsic value.

Valuation of Alibaba

Even when Alibaba has interesting sources for future growth such as the cloud’s growth perspectives, the higher penetration required by the e-commerce in South East Asia, the reopening of the Chinese economy as the COVID restrictions are being lifted, its current cost-cutting strategy, among other factors, we are being very conservative in our future estimations for future revenue growth in order to increase our margin of safety.

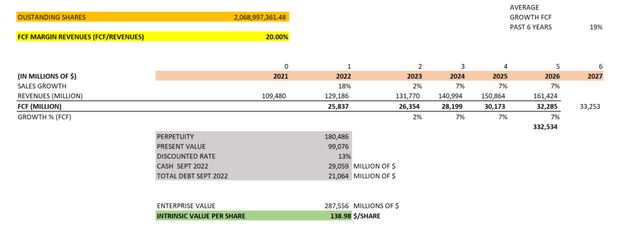

We’ve made the following assumptions for a base case scenario:

- Revenue growth annual projections for 2024-2026: 7%, lower than consensus.

- Outstanding shares: 2,068,997,361.

- Free Cash Flow (FCF) margins: 20%, lower than the average in the last 6 years.

- Discounted rate of 13%; in the middle of regulations, I had assumed 15%.

- Cash on hand: $29 billion as of September 2022.

- Total debt: $21 billion as of September 2022.

- Methodology: Discounted Cash Flow (DCF).

- Buy & hold strategy, long-term orientation holding the stock more than 5 years.

Author

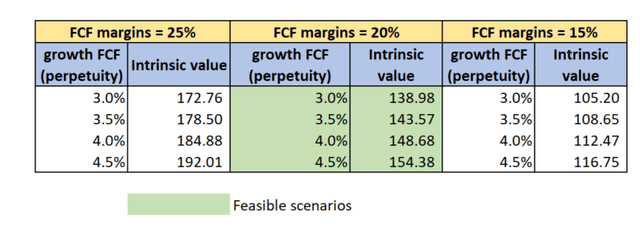

As a base case, we estimate 138.98$ per share as the intrinsic value. Now, we should make a sensitivity analysis to see which are the range of the intrinsic values if some assumptions are changed:

Author

We are considering a low growth of FCF for the long term (perpetuity) despite that Alibaba was able to deliver 19% CAGR in FCF in the last 6 years counting the year 2022 when the FCF declined 52% YoY due to the lockdowns and restrictions in the country. However, with the reopening of the country, we expect a better performance in growth of FCF and revenues in the next years.

In the table above, we may see that the shaded square in green clusters feasible scenarios for Alibaba, estimating a FCF margin for the next years of 20% in average. This is aligned with a strong recovery of the Chinese economy and stronger demand for Alibaba’s services combined with a higher efficiency in its operations. In the last 7 years, Alibaba was able to deliver FCF margins of 27% in average.

If the management is able to push up even more, the efficiency of the Alibaba’s operations to achieve at least 25% of FCF margins for the next years combined with a consistent growth of FCF perpetuity of 3 to 4.5% – these are very achievable targets, the intrinsic value might be boosted to reach a range between $172 and $192 per share without including Ant Group’s valuation.

Incorporating Ant Group’s valuation and the common prosperity policy

We take the average of the Ant Group’s valuations of Fidelity, BlackRock and T. Rowe Price. Also, we know that Alibaba has 33.33% of participation in Ant Group, so we multiply the average intrinsic value of Ant by 33.33% of Alibaba, and then we divide it by the Alibaba’s outstanding shares. So, we get that Ant Group is worth $15.37 per Alibaba share which will be added to Alibaba’s intrinsic value – the base case, of $138.98 per share.

Now, we’ll take into account the common prosperity policy in which Alibaba is required to pay $15.5 billion in equal annual installments until 2025. We take the present value of those installments using the same discounted rate of 13% for the Alibaba’s DCF method previously shown, then we divide this number by the Alibaba’s outstanding shares, so we get $3.13 per Alibaba share:

Ant’s valuation and common prosperity (Author)

The Alibaba’s intrinsic value of $138.98, including Ant Group’s valuation of $15.37 per share and subtracting the expenses for common prosperity taken to present value of $3.13 per share, is $151.23 per share. Note that the base case intrinsic value of $138.98 which is added to an average Ant’s valuation and the present value of the expenses for common prosperity, was calculated under very conservative assumptions, so this intrinsic value of $151.23 could be even higher.

As you may see, the common prosperity policy does not have a significant effect in the calculation of the Alibaba’s intrinsic value, but, at the same time, it might have a positive long-term effect since this policy looks for raising the income of low-income groups, promoting fearness, and making regional development more balanced. This could increase the purchasing power of very low-income groups which might boost the future demand for more products and services through the platform of companies like Alibaba.

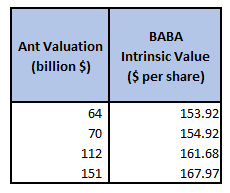

Now, we’ve seen a wide range of the Ant Group’s valuation, so we’ve made a sensitivity analysis to see how the different approximations in Ant’s valuations can change the Alibaba’s intrinsic value:

Author

Again, these numbers are based on the base case Alibaba’s intrinsic value of $138.98 adding the different Ant’s valuations and subtracting the $3.13 per share of the common prosperity in each case. Thus, the Alibaba’s intrinsic value might increase as that of Ant’s increases. Investors with a very long-term orientation could be benefited from the possibility that Ant’s worth might be close or higher than $100 billion combined with an Alibaba’s solid management execution as it has been in the past.

Challenges to the thesis

These risks involve Alibaba and Ant Group:

There are some challenges that might affect our thesis; for example, the government continues with more regulations, punishing big-tech companies like Alibaba with more fines and causing more uncertainty respect to a potential next Ant’s IPO. However, as per a top central bank official, the crackdown on fintech operations of more than a dozen internet companies is over. Therefore, there will be an overhaul that the recently implemented policies are being fulfilled, and companies like Alibaba and Ant Group are adapting well to these changes to avoid any future fine or problem with regulators. Ant Group is still in an ongoing process to fully ending up its restructuring, but it’s taking important steps to successfully complete its regulatory requirements.

Other risk frequently mentioned is the possibility of a delisting of Alibaba stock from the New York Stock Exchange (NYSE) since this scenario could cause a significant volatility. As long-term investors, we should not be worried about a delisting risk as we might take advantage of lower prices to buy shares to reduce our average cost given that this risk is not associated with the business model. Nevertheless, the probability of this scenario has been reduced significantly since the SEC got access to the books from the U.S.-listed Chinese companies for the first time in history in September 2022. We need to wait for a final document after the revision of the accountability by the SEC; but we think that this risk is almost no-material as the main factor for a delisting possibility was that the Chinese government did not want to allow the revision of the U.S.-listed Chinese companies’ accountability; now this factor was removed out of the equation.

Also, the positive measures taken by the Chinese government with respect to the delisting risk indicate us that they are very well interested in the U.S. listed Chinese stocks continue to be traded in NYSE, so the probability that the Chinese government declares the VIE structure illegal is no significant as that situation means that any Chinese stock would not be permitted to be traded in foreign markets; thus the risk associated to the VIE structure is limited as well.

Competition might be another risk given the fact that there is an aggressive competition from companies like JD.com (JD) or Pinduoduo (PDD), but Alibaba has the upper hand in terms of cash flows generation since Alibaba has better FCF margins than these two competitors, which enables the company to have more money to reinvest into its core business to reinforce its long-term competitive advantages.

Finally, there are investors who think that the Chinese government will not allow that Ant Group grow in order to avoid losing power. By the contrary, we think that all these regulations experienced by the fintech sector and big tech companies in China in the last 2 years were to put order in their operations and contribute with a more sustainable long-term growth without representing a threat for the Chinese government. This is one of the main reasons why we consider Alibaba stock a buy.

Final Thoughts

In this article, we’ve incorporated the Ant Group’s valuation within the calculation of the Alibaba’s intrinsic value since the market might have overlooked the fact that Ant still has some worth for Alibaba’s long-term investors even considering a cut in Ant’s valuation as a result of the regulations.

Alibaba stock is a buy for reasons associated to its own business like the expansion of Cainiao, AliCloud, the ecommerce in South East Asia, its business model resiliency, or even the culture organization of innovation instilled by Jack Ma since its inception in 1999; however, Ant still represents another meaningful long-term driver for Alibaba stock, so investors with a long-term orientation could consider this factor in their investment decisions to buy this stock.

Finally, we should not forget that Alibaba is an important position within the Daily Journal Corp’s portfolio with a weight of 15.15% as of December 2022; and we all know that Charlie Munger has a very long-term vision of buying outstanding companies at an adequate price. Buying high quality stocks that are facing a temporary setback could be very well rewarded if we identify those stocks while being dismissed by the market.