Apple (AAPL) Plans to Shift Some MacBook Production to Thailand

Apple AAPL is mulling moving some MacBook production to Thailand as part of its broader plan to reduce its dependency on China for manufacturing its devices. Thailand has been already mass-producing Apple Watch over the past year. It also produces AirPods and some iPads.

Per the latest Reuters report citing NIKKEI Asia, the iPhone maker is in active discussion with suppliers, already having an existing manufacturing footprint in Thailand to make MacBooks. Apple is set to start mass production of some MacBooks in Vietnam shortly.

The company’s plan to reduce its dependency on China can be attributed to the turbulent relationship between the United States and China, as well as its intention of expanding its manufacturing footprint in Southeast Asia countries, including Vietnam and Thailand.

Moreover, India has evolved as the preferred production base for Apple devices, particularly iPhone. According to the latest Bloomberg report, Apple assembled more than $7 billion worth of smartphones in India in the last fiscal year. It is also expected to move some AirPods and Beats earphone production to India.

Apple’s latest initiative to expand manufacturing footprint is expected to boost prospects. Shares have gained 23.2% year to date, outperforming the Zacks Computer and Technology sector’s growth of 17.7% and the S&P 500’s rise of 7%.

However, challenging macroeconomic conditions and lower demand for Mac and iPad are expected to hurt growth ahead of the fiscal second-quarter results set to be reported on May 4.

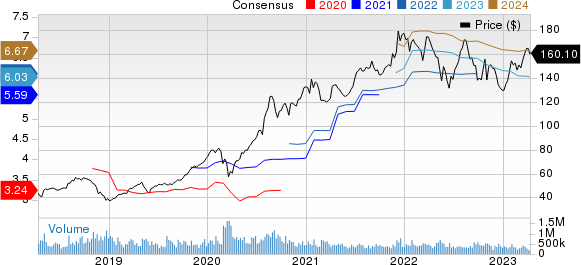

Apple Inc. Price and Consensus

Apple Inc. Price and Consensus

Apple Inc. price-consensus-chart | Apple Inc. Quote

Although Apple did not provide revenue guidance for the second quarter of fiscal 2023, it expects the March-end quarter’s year-over-year revenue growth to be similar to that reported for the December-end quarter due to unfavorable forex of roughly 5%.

The Zacks Consensus Estimate for fiscal second-quarter earnings is pegged at $1.43 per share, down by a penny over the past 30 days. The consensus mark for revenues stands at $93.11 billion, indicating a year-over-year decline of 4.29%.

Apple Mac Prospects Not Bright in 2023

Apple’s Mac has been suffering from lower PC demand year to date. Per IDC’s latest data, global PC shipments totaled 56.9 million units in the first quarter of 2023, down 29% due to sluggish demand and excess inventory.

Apple registered the highest fall of 40.5% to 4.1 million units, followed by Dell Technologies’ DELL 31% to $9.5 million PCs. PC volumes of Lenovo LNVGY and ASUS fell 30.3% to 12.7 million and 3.9 million units, respectively. HP Inc.‘s HPQ shipments contracted 24.2% to 12 million units.

Lenovo also maintained its market share of 22.4%, trailed by HP and Dell, with market shares of 21.1% and 16.7%, respectively. Apple registered a 7.2% market share, down from 8.6% in first-quarter 2022.

For the second quarter of fiscal 2023, Apple expects Mac and iPad revenues to decline in the double digits on a year-over-year basis due to challenging comparisons and macroeconomic headwinds.

In the fiscal first quarter, Mac sales of $7.74 billion decreased 28.7% from the year-ago quarter and accounted for 6.6% of the total sales. Meanwhile, iPad sales of $9.4 billion improved 29.6% year over year and accounted for 8% of the total sales.

The Zacks Consensus Estimate for fiscal second-quarter Mac revenues stands at $8.029 billion, indicating a 23.1% year-over-year decline.

The consensus mark for iPad revenues is pegged at $6.719 billion, suggesting a 12.1% year-over-year decline.

Moreover, iPhone sales are expected to have suffered from lower demand. The Zacks Consensus Estimate for iPhone sales is pegged at $49.605 billion, indicating a 1.9% year-over-year decline and a 24.6% sequential decline.

For second-quarter fiscal 2023, Services revenue growth is expected to be negatively impacted by challenging macroeconomic conditions, as well as weakness in digital advertising and gaming. However, this Zacks Rank #3 (Hold) company expects revenues to increase year over year. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for fiscal second-quarter Services revenues is pegged at $20.86 billion, indicating a 5.3% year-over-year decline.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Apple Inc. (AAPL) : Free Stock Analysis Report

HP Inc. (HPQ) : Free Stock Analysis Report

Dell Technologies Inc. (DELL) : Free Stock Analysis Report

Lenovo Group Ltd. (LNVGY) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research