Apple Search Ads Cost: CPT, CPA and CR Benchmarks 2022

How can you make sure that your Apple Search Ads campaigns are reaching their true potential and the App Store ads cost remains firmly under control? At SplitMetrics Acquire, we know that the evaluation of your Apple Search Ads performance is much easier with industry benchmarks at hand. This is why we always keep our finger on the pulse of the mobile app market, analyzing millions of app downloads, keywords, and billions of impressions. Our analysts provide quarterly overviews of the main Apple Search Ads metrics: TTR, CR, CPT and CPA, along with market insights from the mobile industry leaders.

In this article, we decided to showcase a brief overview of the Apple Search Ads benchmarks and the macro-trends of the first half of 2022 from costs per tap (CPT), through tap-through rate (TTR), costs per acquisition (CPA) to conversion rates (CR). We analyze these metrics for top app categories. We shed some light on the interesting topic of measuring cost per actual install (CPI) and discuss managing Apple Search Ads pricing.

Want to stay up to date with the latest data? Download the most recent benchmark reports:

Mục Lục

Apple Search Ads Benchmarks

To answer this mobile app marketing benchmark question and uncover average CPT, CPA and TTR by app categories, for the first two quarters of 2022 we analyzed:

- 1.6 billion impressions;

- 101.2 million taps;

- 64.6 million app downloads;

- 3.8 million keywords;

- 15 categories;

- 61 countries.

In order to help you understand these numbers better and optimize your Apple Search Ads for the best results, we’re also sharing key factors that determine Apple Search Ads price and – what’s even more important – our tips for managing your App Store Ads cost and performance.

Grow your Apple Search Ads ROI

Talk to Expert

Mobile App Marketing Benchmarks: App Store Ads Cost per Tap (CPT)

Since in Apple Search Ads you’re paying for nothing but taps on your ads, let’s start with the average CPT.

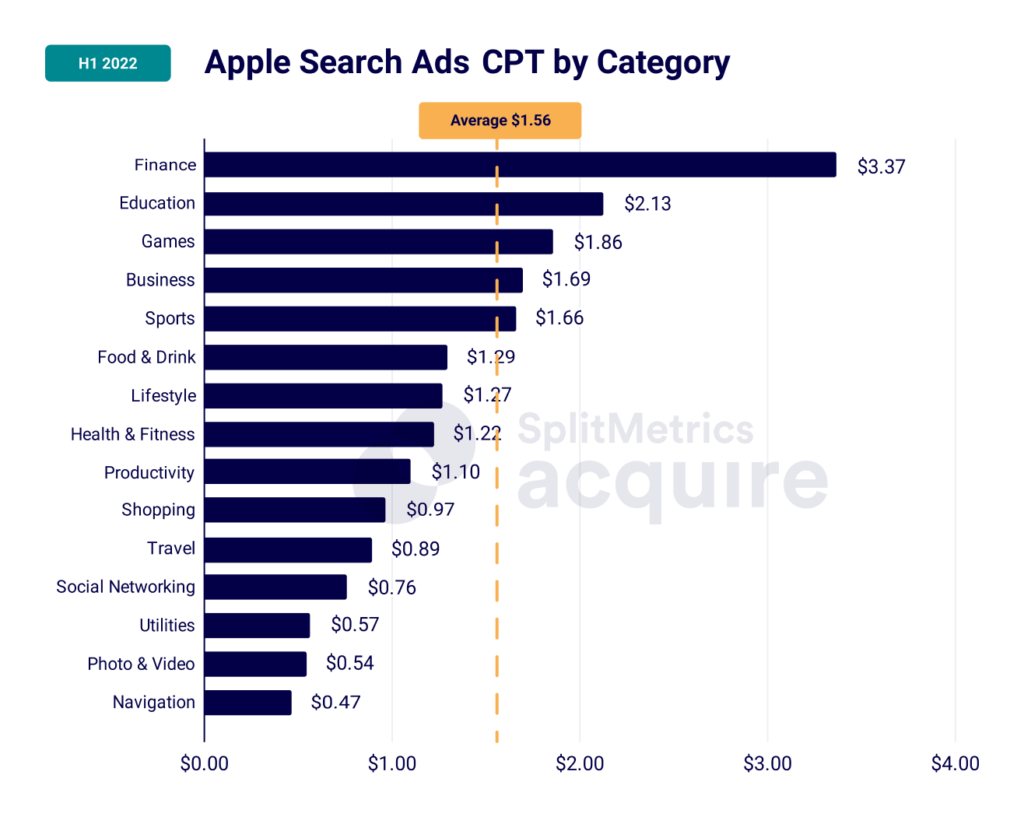

In the first half of 2022, the average Cost per Tap of Apple Search Ads was about $1.56. Values of CPT for top 15 categories are shown on the chart below:

Chart 1: Apple Search Ads Cost Per Tap by App Store category. Source: SplitMetrics Apple Search Ads Benchmarks H1 2022.

Chart 1: Apple Search Ads Cost Per Tap by App Store category. Source: SplitMetrics Apple Search Ads Benchmarks H1 2022.

Finance and Education were the most expensive categories, with the average CPTs standing at $3.37 and $2.13 respectively. Games came in third place with $1.86, followed by Business ($1.69) and Sports ($1.66). All other categories, including popular ones such as Lifestyle, Food & Drink ranked below the average.

The value of CPT (and the App Store advertising cost in general) is driven by competitive bidding. This is the nature of all auction based platforms and strategy plays a bigger role in such an environment than a category’s physical population of available apps (or products for that matter). A smaller bunch of big players with money to burn can create a much more challenging conditions for marketers than a larger population of smaller publishers. Finance is an excellent example of this mechanism: although this year’s $3.37 average CPT may seem high, it pales in comparison to last year’s over $11.73, a value driven by a boom in the cryptocurrency segment that went as quickly as it came, in a category that shares less than 5% of the App Store’s apps.

For reference, keep an eye on the App Store’s most popular app categories on Statista.com.

Mobile App Marketing Benchmarks: Apple Search Ads Tap-through Rate (TTR)

What factors matter when it comes to Tap-through Rate? Well, it’s complicated.

Early conversion experiments with Apple Search Ads had shown that average users didn’t understand that they dealt with an ad and behaved like organic users would, providing a high tap-through rate (a result of the striking visual similarity between Apple Search Ads and organic results). However, our studies of TTR’s in following years in Apple Search Ads have repeatedly shown that users recognize and even sometimes ignore paid ads, focusing on organic results.

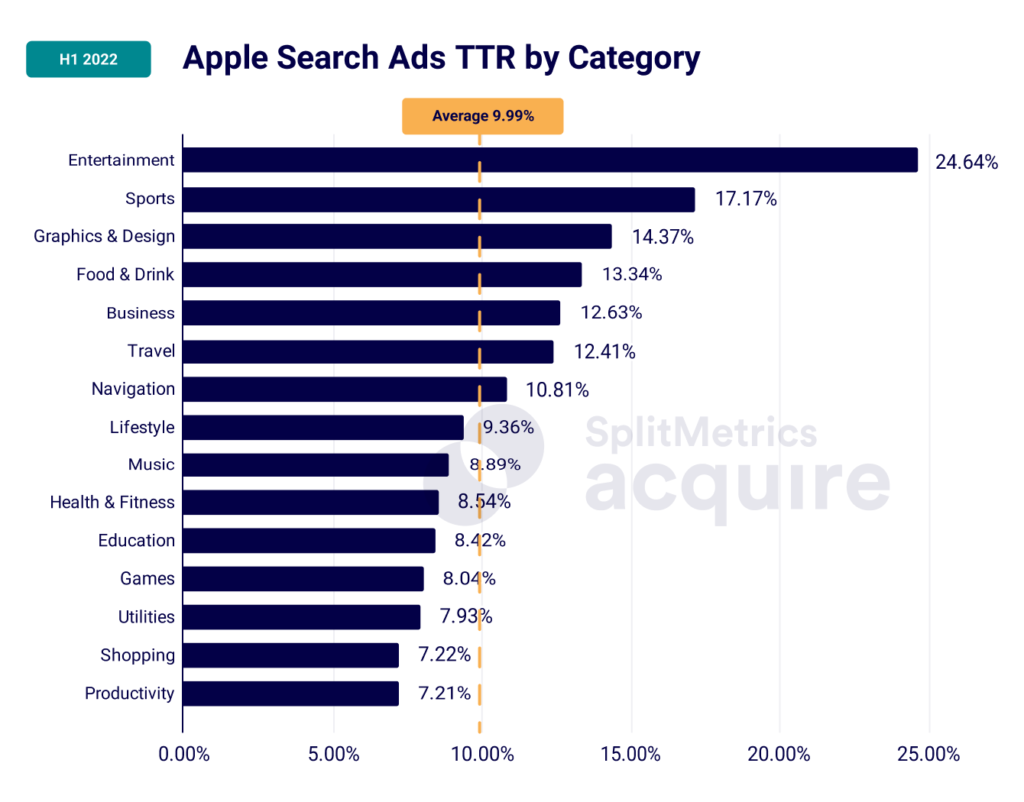

It’s clear though that more factors are at play when you look at the chart below:

Entertainment topped the ranking, with an outstanding 24.64% TTR, followed by Sports (17.17%), Graphics & Design (14.37%), Food & Drink (13.34%), Business (12.63%), Travel (12.41%) and Navigation (10.81%), all of them sitting well above the first half’s average TTR of 9.99%.

Even at a first glance we can see some rather big changes from the year before. For comparison, in the second half of 2021 Entertainment had a TTR of 18.79% and was topped by Sports with 19.86%.

Remember Finance and Education and their very high CPT’s? Well, Education sits there at 11th place with a low TTR of 8.52% and Finance didn’t even make the list.

To wrap up past and present findings, here are the most important takeaways from these figures:

- High TTR generally signifies that users in that category are looking for specific brands and apps and are using Search with the intent to install. This may be true for the Entertainment category, which hosts all the biggest streaming apps, like Amazon Prime Video, Disney+, Netflix or HBO Max. A big tentpole release may result in a surge of users, both new and returning, seeking to install or reinstall these apps. Same may be true for the Sports category, where a major event can shift its position dramatically – like to FIFA World Cup Qatar 2022 for instance. In the second half of 2022, Sports may beat Entertainment in the TTR category, just like it did in the second half of 2021.

- Low TTR is a sign that discovery keywords (related to the app’s functionality or purpose) play a larger role. Users may also choose organic results instead of an ad or simply keep scrolling looking for more options, unsure where to allocate their trust.

This trend isn’t new and despite some users opting for organic results (thus, lowering TTRs), remains true in 2022. Take a look at top App Store keywords gathered by AppTweak in 2022: instagram, facebook, snapchat, tik tok… others are probably also familiar. That means the majority of the App Store searches are not about discovery. It’s about a means of accessing something specific.

All in all, the most important lesson is this: know your user and app category. Motivations and user journeys vary so significantly between them that we have to know as much as possible about them to succeed. Also, seasonality matters for many categories.

For reference, we encourage you to download the most recent and past reports:

Mobile App Marketing Benchmarks: Apple Search Ads Conversion Rates (CR)

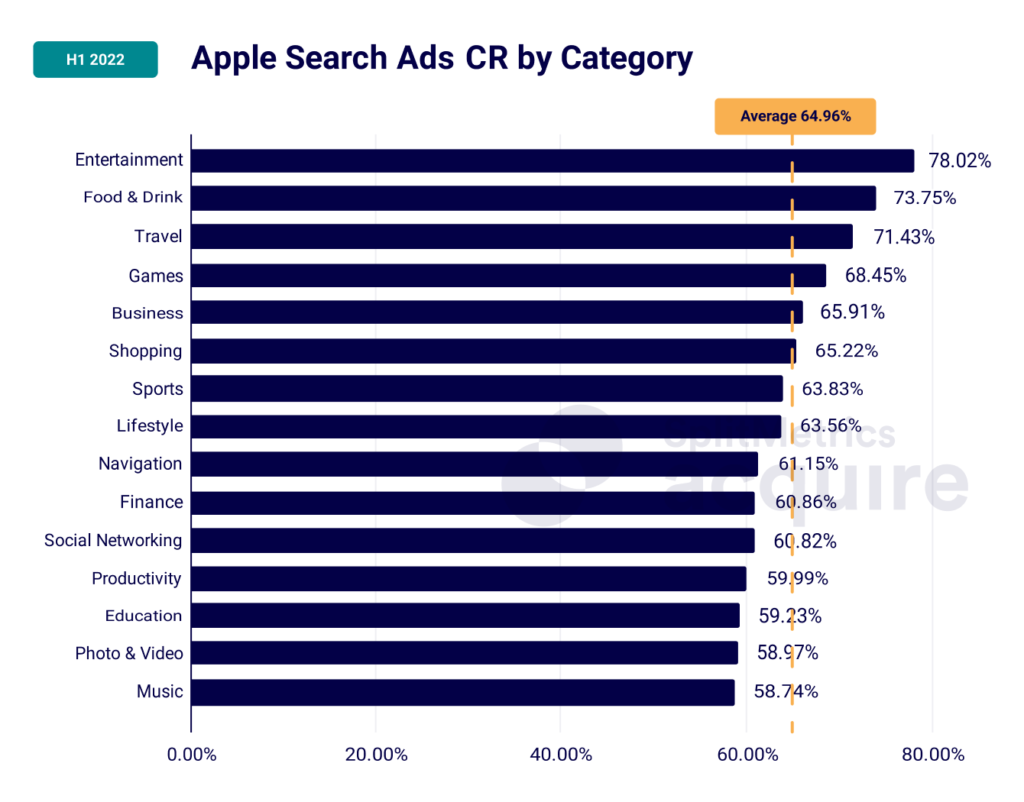

Conversion Rates reflect the likelihood of the user tapping the “GET” button after visiting your product page on the App Store (or in some instances, directly after searching). The value of this metric can vary greatly between categories as shown on a chart below:

Chart 3: Apple Search Ads Conversion Rate by App Store category. Source: SplitMetrics Apple Search Ads Benchmarks H1 2022.

Chart 3: Apple Search Ads Conversion Rate by App Store category. Source: SplitMetrics Apple Search Ads Benchmarks H1 2022.

The average conversion rate for the first half of 2022 was 64.96%. Note, the difference between the best performing category “Entertainment” and the worst one “Music” is a staggering 19.28%. Both categories of apps are a good example of how unique the Apple App Store is, with conversion rates of 78.02% and 58.74% probably not seen anywhere else (save perhaps for some outstanding remarketing campaigns). These figures are yet another example of how important it is to understand user behavior and intent for a given app category.

Take Finance, the top category in terms of CPT and CPA. With CR sitting at a relatively low 60.86% (4% below the average) it is clearly visible that high user acquisition costs aren’t just a result of tough competition, but also reflect a customer’s journey very different from the one taken to install a game. While we may quickly install a “try for free” game (leading to high conversion rates for this category), it’s reasonable to assume that we must do more to reaffirm people landing on our product page that our app solves their problem.

In other words, it shows how important app store optimization strategy truly is.

That’s why before app marketers start investing in Apple Search Ads, it makes sense to optimize their product pages. Mobile A/B testing with SplitMetrics Optimize is one of the most efficient and trustworthy ways to do it. Only by perfecting all store page elements, app publishers are able to make the most of Apple Search Ads.

The example of the Game category proves it. This App Store segment is famous for its extreme competition which makes game publishers take care of their product page optimization.

Thus, optimized store pages of games mitigate the impact of high CPT and favor effective Apple Search Ads activity.

Alright, it’s time to learn another highly important mobile app marketing metric – how much you pay for one acquired user.

Mobile App Marketing Benchmarks: App Store Ads Cost per Acquisition (CPA)

Cost per Acquisition (CPA) is the mobile app marketing metric that indicates how much you pay for every “GET” button tap.

CPA plays a special part here as every mobile marketer aims at achieving a low cost per acquisition. But, how low is low enough when it comes to this mobile app marketing metric? What costs per tap and install should you expect when working with Apple Search Ads?

The average Apple Search Ads Cost per Acquisition was about $2.40, but varied significantly for different categories:

Chart 4: Apple Search Ads Cost Per Acquisition by App Store category. Source: SplitMetrics Apple Search Ads Benchmarks H1 2022.

Chart 4: Apple Search Ads Cost Per Acquisition by App Store category. Source: SplitMetrics Apple Search Ads Benchmarks H1 2022.

Finance yet again topped the chart with an outstanding $5.54 on average per acquisition with follow-up Education equating to a much lower $3.59.

Three more categories had above average CPA – Games ($2.72), Sports ($2.60) and Business ($2.57). High CPT doesn’t necessarily translate into a high CPA, which can all be attributed to sometimes significant differences in conversion rates (CR) between categories.

This is it — the final step in our analysis. Within the context of CPT, TTR and CR discussed earlier in the article, this chart should serve as a conclusion of what we would like our readers to remember: the difference between motivations of users searching for apps and their journeys to installation, the big effect of seasonality and the crucial role of optimization.

Mobile App Marketing Benchmarks: Apple Search Ads Cost Per Install (CPI)

In the context of CPA, we need to discuss one last metric: Cost Per Install (CPI). CPI isn’t a part of the core Apple Search Ads platform, but functions in the SplitMetrics Acquire ecosystem.

In Apple Search Ads, installs are equated with downloads, or rather the instance of a user tapping the “GET” button, which doesn’t have to result in a physical installation of an app. Connectivity issues or other errors can interrupt the installation process and thus lead to data discrepancy. The “traditional” CPA doesn’t account for reinstalls from already acquired users or instances where the app wasn’t even opened after installation.

We see it in our data: the number of app page visitors who tap “Get” differs from the number of visitors who eventually install the app. Therefore, the actual CPI can be higher than CPA.

This is why in our platform SplitMetrics Acquire we allow for customization of how installation is defined. In essence, it can be any in-app event that you think will best reflect the final step in the acquisition process. Installation can be counted when the user opens the app or even performs a specific action, like registering an account or launching certain features. We acquire this information thanks to our integration with various MMP, responsible for in-app behavior analytics.

In any case, for the purpose of our report “Apple Search Ads Benchmark Report H1 2022” we used data from the App Store for consistency. Just remember what this official metric actually represents and that there are custom alternatives that can and will help you analyze acquisition costs in the context of your business goals.

You can read more about optimizing your campaigns for installs in this whitepaper.

Should you decide that a customized approach to calculating CPI best reflects your business model and monetization plan, connect the app attribution system from your Mobile Measurement Partner (MMP, like AppsFlyer, Branch, Adjust, Kochava, TUNE, etc.) with SplitMetrics Acquire, an Apple Search Ads optimization platform, and see the App Store ads performance on all levels in one place. It can be a very simple process that doesn’t have to involve any additional IT resources. SplitMetrics is actively cooperating with various mobile measurement partners and their systems are prepared for a quick, integrated startup.

App Store advertising cost: not actually high

Is the average $2.40 Cost per Acquisition low or high? Given the large differences between categories, it makes more sense to assess CPA individually.

App Store advertising cost is determined entirely by app publishers. Apple Search Ads functions on an auction basis, which means that the price you pay for a tap is the bid of your closest competitor + $0.01. The more competitors there are and the more aggressive their bidding is, the higher the Apple Search Ads price.

How to improve Apple Search Ads performance

Before joining a big auction and competing with other advertisers on Apple Search Ads, it might be also great to look at key factors that determine Apple Search Ads cost and learn how to adjust the CPT you’re getting to your mobile app marketing goals.

Know your audience, category and competitors. The relevance score of Apple Search Ads ensures you compete only with relevant applications. It is likely that these applications will be from the same category and weight class as your app.

This way, Apple eliminates CPT bid peaks and provides conditions for a fair competition for app publishers. Analyzing benchmarks for categories relevant to your app should definitely become a part of your mobile app marketing strategy, as it translates directly into your ability to predict and control Apple Search Ads pricing.

Check the Guide on how to reduce CPA and CPI for your mobile app here.